Estimate reviews are part of the process in property restoration, how do we minimize our losses? Rejections sucking the blood from your estimates Rejections sucking the blood from your estimates Time is invaluable. It’s the only thing that we cannot purchase more of. In business when we are able to reduce wasted time we are able to increase our efforts in profitable endeavors. Wasted time is money bleeding out of your organization. For those who have written estimates for an insurance claim, you know what it feels like to have your line items questioned by adjusters or your estimate picked apart by claims reviewers. Property restoration contractors often perceive the claims review process as a constant bleeding out of effort, energy and sanity. It’s hard to produce for clients when you feel like you are always treating the wounded in your estimator bullpen. How often have do restoration estimators say:

Maybe this hasn’t happened to you but you’ve heard your peers complaining. Just wait, every estimator knows that their estimate will soon be the next victim of the insurance review gauntlet. The next time you send an estimate to a reviewer or hit upload in Xactimate, the process will run its vicious cycle with you. For those willing to admit it, are your bruises still turning purple or are your wounds still bleeding? We all have choices to make. We can play the status quo game and complain about the system or we can work to find answers. What would the typical response be as this scenario plays itself out?

Funny enough, this is both one of the issues as well as one of the keys to resolution as well. The person reviewing you claim has never been to this job. They typical claims reviewer works from a claims center half-way across the country. You are correct, they likely haven’t been to any job and possibly never will. It’s not their job. This is a fact of the process and it does no good to complain about it. Your roles should not put you at odds. One of you writes an estimate for the claim and the other reviews the estimate for the claim. Either of you may view your responsibilities to be at odds with each other but that is not inherent to the task at hand. The presiding principle should be to restore the client to pre-loss conditions and both parties should be working together to make this as expedient as possible. The difference between what should be and what is leaves a lot of room for us to work towards a process that is clear and consistent. As restoration professionals we can start by asking better questions.

As an estimator you have the responsibility to learn how to tell the story of the loss through the estimating tool. The estimate has a language. Whether you like it or not, for the majority of insurance claims, Xactimate has become the recognized story delivery tool. When your story does not resonate with our audience you need to learn how to communicate more clearly. In serving your client, it is necessary to use the resources in your tool bag to assist them in achieving a well executed outcome. If your estimate is not compliant with basic carrier requirements, rejection is not the result of sadism its self-sabotage. How do contractors gain ground in the claims review process?

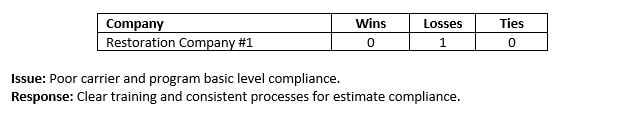

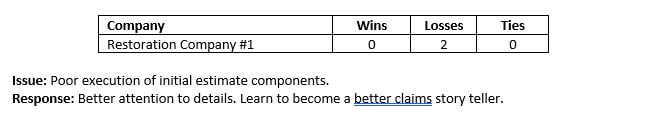

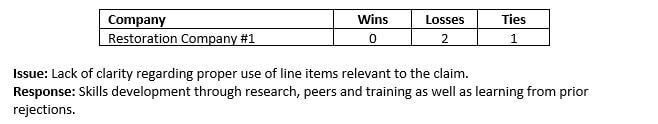

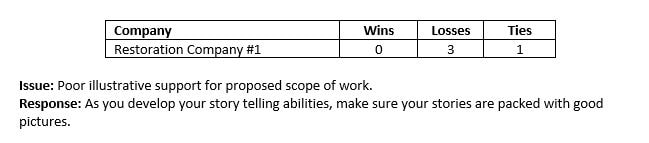

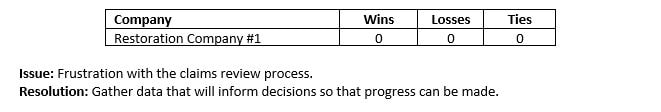

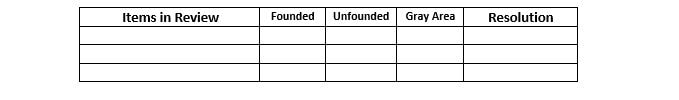

Start the process of reviewing your rejections for trends. You can do this as a team or you can do this as an individual estimator. To assist you with collecting data we have developed a FREE PDF download -Tracking Claims Review Worksheet. Gathering this information will help you to make informed decisions about your process, adjustments for your team’s approach as well data to discuss with adjusters, claims reviewers or carriers.

Resources for estimators, managers and adjusters composing estimates in Xactimate:

0 Comments

Thinking through our mindset and process for claim reviews to achieve better outcomes. Is this how you imagine estimate reviewers? Is this how you imagine estimate reviewers? “They’ve shredded my estimate!” Exclaimed Estimator #1. “Again?” Replies his peer, Fellow Estimator. “It’s like they take joy in their sadistic responses.” Estimator #1 progresses from shock to anger. “So brutal.” Fellow Estimator commiserates. They literally took my restoration estimate and ran it through a cheese grater.” Estimator #1 continues to wallow in misery. “How do they expect us to make any money?” Fellow estimator attempts to console their compatriot. Fellow Estimator knows that their estimate will soon be the next victim of the insurance review gauntlet. They knows that the next time they sends an estimate to a reviewer or hit upload in Xactimate, the process will run its cycle with them. Have you been in this room before? If you work around insurance claims, you know this scenario is a common one in many restoration companies. Perhaps your own bruises are still turning purple and your wounds are still bleeding. We all have choices to make. We can play the status quo game and join our peers, Estimator #1 and Fellow Estimator in their glum state or we can work to find answers. Many of you are saying, we have tried. If you will journey with me a bit further into this scenario, perhaps we can assess our effort and dive a bit deeper into making progress in the process. What would the typical response be as this scenario plays itself out? “Who are they to question me?” Estimator #1 rises indignantly and then rattles off a hastily worded email. “This claims review ‘professional’ has never been to this job – they’ve probably never been to any job site ever.” Fellow Estimator exclaims. Funny enough, this is both one of the issues as well as one of the keys to resolution as well. The person reviewing Estimator #1’s estimate has never been to this job. Claims Reviewer #1 works from a claims center half-way across the country. Claims Reviewer #1 likely hasn’t been to any job and possibly never will. It’s not their job. This is a fact of the process and it does no good to complain about it. Their titles do not put them at odds, one writes an estimate for the claim and the other reviews the estimate for the claim. They may view their responsibility to be at odds with each other but that is not inherent to the task at hand. The presiding principle should be to restore the client to pre-loss conditions and both parties should be working together to make this as expedient as possible. The difference between what should be and what is leaves a lot of room for us to work towards a process that is clear and consistent. We can start by asking better questions. “What are the objections of Claims Reviewer #1?” Estimator Supervisor asks. “Who invited you?” questions Fellow Estimator. “My company header isn’t in the estimate,” replies Estimator #1. Have you experienced this rejection note? It seems silly but it’s a requirement. Should anyone on the contractor side be upset with the claims review process if they have not updated their program to have the correct company information in their estimate headers? Who’s responsibility is it to ensure that their organization is following the basic requirements for carriers and programs? “It appears that Claims Reviewer #1 composed a detailed list of their reasons for the rejection of your estimate. What is the next objection?” inquires Estimator Supervisor. “My opening statement does not provide sufficient details per the carrier requirements,” Estimator #1 reads with a quizzical tone in their voice. While we are laboring into the weeds a bit here we are also discussing elements of Insurance Claims 101. These are common rejection items that are easily addressed and yet continue to be hang ups for restoration companies large and small. If you read our article on the Habits of Xactimate Estimating Success, we outlined how your estimate is part of telling the story of the claim. As estimators we have the responsibility to learn how to tell the story of the loss through the estimating tool that we use. The estimate has a language. Do you remember when you first sat down with Xactimate? It can seem like a foreign language. What is WTR EQD? What does HMR BARR mean? When is the right time to use PNT MSKLF? Whether you like it or not, for the majority of insurance claims, Xactimate has become the recognized story delivery tool. When our story does not resonate with our audience we need to learn how to communicate more clearly. In serving our client, it is necessary to use the resources in our tool bag to assist them in achieving a well executed outcome. If your estimate is not compliant with basic carrier requirements, rejection is not the result of sadism its self-sabotage. “They are picking apart my line items,” Estimator #1 yells, pounding a fist against their desk. “They do that to me all the time,” Fellow Estimator raises their hands in disgust. “I remember when I used to be an estimator…” Estimator Supervisor starts to chime in, thinking that they are a part of the group grievance session only to be interrupted. “No one cares about what you did eighty years ago!” both Estimator #1 and Fellow Estimator blurt out. We are now entering much more subjective territory. There are ongoing discussions about the best ways to approach insurance claims work from various levels of the business. Resources like Restoration & Remediation Magazine do a great job of giving a voice to industry leaders and their experiences. Let’s discuss a few options when faced with opposition from an insurance reviewer: Estimate Rejection Response Option #1Dig our heels in. There are those of the mind that the carrier can never be right and the claims process is a war. If they want to question us we will know the fine print better than them and will throw it at them with everything that we have. If your organization has agreed to do program work then some of these line item concessions are part of the contractual agreement. This is why some companies have chosen to stay independent and refuse to engage in third party administrator (TPA) work. If you a person in a position of leadership you will have to decide if the potential volume is worth the tradeoff. Estimate Rejection Response Option #2Give in to expedite. Some professionals believe that a quick claim that is paid in part is better than a drawn out battle. Many of the organizations that regularly work with carriers or TPA’s exercise some level of pragmatism. As noted previously, the theory is that concessions will be made to build a relationship that will result in a volume of work that will outweigh the costs. For many of these companies this is survival mode, “We don’t know what we would do without program work so we have to do what it takes to keep the funnel open.” Estimate Rejection Response Option #3Get educated. Whether you work with a TPA or are doing direct work for carriers, after a few claims you typically get a sense for the line items that are more likely to get rejected or questioned. Know your program outlines, your carrier specifics and what sequences can be approved (or overridden) by adjuster authorization. If you have a claim that requires a unique approach you should be in contact early and regularly with the adjuster to confirm authorization for your approach to assisting their client with a positive outcome.

Were Keith Richards and Mick Jagger in the property restoration business prior to forming The Rolling Stones? Did they have insurance estimate reviews in mind when they penned the timeless words, “You can't get what you want. But if you try sometimes, well, you might find you get what you need.” If you write a sloppy estimate and you are not learning from prior mistakes, expect to get rejected. At the same time, whenever the carrier or program initiates are rejection of an estimate this should be a time where the restorer reviews whether the objections are legitimate. This invitation to review the merit of the estimate is also a time when the estimator should review whether legitimate line items were missed in the prior submission. “They are saying we don’t have sufficient supporting photos,” Estimator Supervisor states looking up from the computer screen. “Oh, and the photos that were uploaded aren’t properly labeled or associated with the rooms in which they were taken,” continues Fellow Estimator. “What?” queries Estimator #1. If a photo is worth a thousand words, in the world of insurance claims those photos could be thousands of dollars. One hundred dollars (or even less) can be the tipping point between a profitable project and a net loss. A clearly written estimate that follows industry guidelines must have supporting photo documentation – we aren’t yet talking about high level Xactimate skills. Estimators are story tellers. Our audience likes their stories to be full of vibrant pictures that are captioned. Often we are communicating our claim stories to persons who will not be physically present at the loss. Pictures help the claim story to come to life for them. Develop your ability to tell a story and to support your story with multiple photos that are clearly labeled to illustrate your narrative. The more detailed or unique the work you need to complete the more quantitative as well as qualitative your photographs need to be. If we have a losing mindset and we maintain the status quo of losing habits, we will continue to lose. Estimators have a job to do. Claims review professionals have a job to do. Organizations have a responsibility to train their people to execute with excellence when it comes to carrying out the essential functions of their roles. “I don’t know what I am going to do,” Estimator #1 is on the verge of tears, “No matter how I respond they are going to tear me to pieces.” “When the claims reviewer shreds your estimate, it’s time to make tacos!” “Who said that?” Fellow Estimator yells into the abyss. Suddenly, they can hear a familiar tune, “You can’t always get what you want…” “But if you try sometimes,” Estimator #1 bobs their head. “Is it lunch time?” Estimator Supervisor asks as they leave the room. Unfortunately, more often than not, our responses to the estimate review process borders on burying our head in the sand or playing the victim. We throw our hands up and rail against the system. As noted above, we can choose to go to war, we can choose to give in or we can choose to get educated. Neither of these decisions guarantee success. Going to war will have casualties, giving in will cost you and getting educated does not mean that everyone will admire your knowledge to the point that they will see things your way. You may feel like you have lost in the past but today is a new day, it’s time for a new approach – the “scoreboard” is blank (but the clock is ticking). So, how do we gain ground on the claims review process? Here are some suggestions to start tracking data to inform decisions and find resolution:

You do insurance work. Claims review is part of the process. Our point here is not that insurance is right or that contractors are wrong, but that if we want to achieve progress in the process we have to control what we can control. Take ownership for roles and responsibilities. If you are not collecting data on your rejections you should start immediately. If you have data you need to use it to help educate your decisions so that you can gain ground. Our conversation here is regarding mindset and process. Start gathering data so that you can make more informed decisions and work to find resolutions. Regardless of your chosen approach, develop your process intentionally. Tracking Claims Review Worksheet - FREE PDF

Resources for estimators, managers and adjusters composing estimates in Xactimate:

Learn the secrets to success writing insurance claims with the Xactimate estimating platform. The insurance claims estimating world can feel like a wandering in the dessert for restoration professionals. The frustration with the guidelines of program work and having to be reviewed by third party administrators (TPAs) can bring mitigation and construction estimators to a point where they feel lost and leaderless. Anyone who manages projects within the insurance claims industry must familiarize themselves with reading and writing Xactimate estimates. For those just beginning their journey in estimating insurance claims, you will find our Three R’s of Mastering Xactimate for Beginners to be a helpful baseline for success. The cloud of mystery that surrounds the stone tablets of this industry standard may scare and confuse many, but with the help of these ten commandments for Xactimate mastery you may find that you can achieve success. Estimating with Xactimate Commandment OneThou shalt sketch accurately. Regardless of the tools that you use, make sure that you get your sketch right. An accurate sketch is the key to creating a solid Xactimate estimate. Sketching from the site is one of the best ways to ensure you get odd corners and turns in a unique layout accurate as well as capture all of your line items. Second best is utilizing sketching programs or a good graph notebook. If you are new to sketching for construction estimates, property restoration or Xactimate, check out this video on the foundations of a good diagram. Estimating with Xactimate Commandment TwoThou cannot take too many photos. For those who started in the industry when we had to print photos or save them on 3.5 in floppy disks, there may be some hesitation to take too many photos. With modern digital technology this is no longer true. The more photos that you take the better. Always take photos of the front of loss, source, shots from all corners of affected rooms, affected materials, equipment and any unique components of the claim. Learn what carriers and adjusters are looking for as it is a terrible waste of time to have to run back out to a project just for one shot to justify a key line item. Estimating with Xactimate Commandment ThreeThou shalt label they photos descriptively. Common descriptions should include the room name and what is being represented with the photograph such as “Kitchen floor damage” or “Living room ceiling affected”. Carriers are often requesting that photos be uploaded in relationship to the sequence of rooms in the sketch, this can be easily done by dragging photos into the rooms when uploading into Xactimate. Estimating with Xactimate Commandment FourThou shalt utilize thy F9 notes. F9 notes can be used for formatting but breaking up large sections of line items into categories that make the estimate easier to read for reviewers, adjusters and your production teams. F9 notes can be used to describe how a line item is being utilized, for example DRY LF may have an F9 note of “Repair flood cuts for common wall to bathroom” especially if there is another drywall line item in the room that may be for the ceiling or separate section of wall. If you ever utilized a labor (LAB) line item you must understand that it is going to be questioned and should have an ample F9 note, photographic support for the scope being requested and best to have the designation as “approved by adjuster,” assuming that you have already discussed it with them. Communication is key, utilize this simple function. Estimating with Xactimate Commandment FiveThou shalt document your initial findings. Whether it’s a 12 hour update for a mitigation claim or a loss narrative for a repairs claim, you need to communicate the conditions you have found once you have completed your inspection. For mitigation projects you are communicating the site conditions, source and drying plan. For repairs projects you are confirming the site conditions and outlining the scope of work that you are estimating for. Samples of what should be covered in the twelve hour update as well as the loss narrative for Xactanalysis include: Sample 12 hour update for mitigation projects in Xactimate:

Sample loss narrative for repairs projects in Xactimate

Estimating with Xactimate Commandment SixThou shalt update thy adjuster in real time and document consistently. One of the keys to success for any organization or project management system is communication. A key principle for communication in the insurance claim industry is no surprises. Utilize email, text, phone calls and third-party programs such as Xactanalysis to communicate consistently and clearly with all parties. While some adjusters may have you wait until the end of a claim to compose all of your supplements and changes, you want to make sure that you aren’t waiting until then to communicate and acquire some form of written approval. You want to build relationships with adjusters and claims administrators and communication is a means to making their job easier by not surprising them with alterations to the plans previously agreed to. Estimating with Xactimate Commandment SevenThou shalt learn thy carriers guidelines. While it is impossible to remember all of them unless you are able to specialize with specific carriers, it is important to know the key rejection line items. Pay attention to what you are getting rejected for. Try to not repeat the same mistakes with the same carriers. Every carrier has their general rules as well as their idiosyncrasies. For example one carrier will want contents as CON LAB and another will want to see it as CON ROOM. It should only take one rejection for you to understand and remember which carrier prefers the line item one way or the other. Estimating with Xactimate Commandment EightThou shalt know thy line items – apply thyself to understand the process of line item approvals. If you do not want to be constantly frustrated by rejections you must quickly learn which line items will get rejected by reviewers or will require adjuster approval. When working with third party administrators (TPAs) you will have to work through layers of review and approvals based upon insurance carrier guidelines. If you have a scope of work that falls outside of the norm you will need to get in communication with the adjuster to discuss how they would like that scope of work broken down. A scope and line items that may not pass through the normal review process can be overridden if there is ample explanation through F9 notes, photos and the designation that this has been “approved by adjuster”. Memorization of line items can help boost Xactimate estimating success and expedience

Estimating with Xactimate Commandment NineThou shalt know thy line items – thou shalt understand thy line item descriptions. When you start writing estimates in Xactimate you need to take some time to familiarize yourself with what is and isn’t in a line item. As a general rule, most carriers do not want you to utilize labor (LAB) line items as in theory everything that needs to be done should be covered in a line item scope of work. For those items that are out of the ordinary you need to ensure that there isn’t an Xactimate line item that covers the work you are requesting labor for. Also, ensure that you aren’t duplicating a scope of work that is already covered in the line item while also ensuring that you aren’t cutting yourself short by missing items that are omitted from the line item description. Estimating with Xactimate Commandment TenThou shalt learn to master the tri-fecta of service, expedience and accuracy. Restoration creates the challenge of getting in and getting out expediently while providing a quality service and communicating with multiple parties. When the scope of work falls outside of the timeline requirements be sure to communicate and update frequently. Restoration professionals have to be skilled in the construction and mitigation trades, must be able to provide a high level of customer service which is grounded in communication and are required to be technologically proficient to utilize the industry tools. Insurance claims estimating mastery starts with knowing the guidelines of XactimateWhen Moses came down from Mount Sinai with the two stone tablets, there were questions and fear, but there were also some clear directives. Xactimate and program guidelines generate similar emotions but one cannot argue that there are keys to success when working with the estimating software. You can argue all you want about who gave the directives, who is interpreting the guidelines and whether the system is fair, but you also had better apply your energy to learning Xatimate’s keys to success. If you are just starting out in your estimating journey, you may find our Three R’s of Mastering Xactimate for Beginners to be helpful. Insurance claims are subject to some level of interpretation so mastering the tools of the trade is essential to achieving success with the process. Contact us for coaching and consultation with estimating, project management and process improvement.

|

AuthorThoughts on personal and professional development. Jon Isaacson, The Intentional Restorer, is a contractor, author, and host of The DYOJO Podcast. The goal of The DYOJO is to help growth-minded restoration professionals shorten their DANG learning curve for personal and professional development. You can watch The DYOJO Podcast on YouTube on Thursdays or listen on your favorite podcast platform.

Archives

March 2023

Categories

All

<script type="text/javascript" src="//downloads.mailchimp.com/js/signup-forms/popup/unique-methods/embed.js" data-dojo-config="usePlainJson: true, isDebug: false"></script><script type="text/javascript">window.dojoRequire(["mojo/signup-forms/Loader"], function(L) { L.start({"baseUrl":"mc.us5.list-manage.com","uuid":"b9016446bd3c6a9f0bd835d4e","lid":"83282ffb9e","uniqueMethods":true}) })</script>

|

||||||||||||||

Jon Isaacson |

Connect. Collaborate. Conquer.

© COPYRIGHT 2015. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed