|

We became aware of Insurance Nerds after we reviewed their book Insuring Tomorrow: Engaging Millennials in the Insurance Industry. We previously conducted email interviews with founders Tony and Carly, so it was a great opportunity to do this video interview with Carly Burnham. Here is a brief summary of our conversation, please give a watch and/or listen and then check out their valuable efforts at InsNerds.com. Insurance Nerds was born in 2014. Carly Burnham and Tony Canas met each other working for the same large insurance carrier and continued to work with each other for four years. Tony had previously worked in a claims call center and had moved into underwriting. Carly had a background working in a local insurance agency doing front line customer service. That experience exposed her to a broad range of insurance products and learning how to work directly with clients.

When Carly moved into the call center, where she met Tony, her experience was the opposite of working at a local agent’s office. As she describes, “Selling a product that is very complex, that has a lot of nuances, and you’re talking to people in 26 states to try to connect and make a sale.” Carly and Tony were working with a young professionals resource group coordinating education and networking opportunities within the company. They started blogging on InsNerds to discuss those topics of professional development and maintained that effort even after they both left the large carrier where they met. Insurance Nerds plays an important role in continuing that shared vision of helping young professionals develop career pathways through education and networking. The concepts that became the book, Insuring Tomorrow, had been in discussions for about 3 years when Tony’s partner made the final push to encourage them to write the book. Carly and Tony brought in a copy editor who assisted with the structural plan. For marketing Tony sent out 50 free copies to people whom they felt would be interested and could help create feedback to fuel interest in the product. As Carly notes, the talent crisis is an ongoing issue within the insurance industry, as well as throughout all organizations. Understanding generational and cultural differences is key to success with recruiting and retaining talent. Insuring Tomorrow and the InsNerds website continue to grow as resources speaking into these areas of need. Nick Lamporeli joined the effort bringing a podcast, Profiles in Risk, which expanded the offerings as well as the audience. Early episodes were discussions between Nick, Carly and Tony but the podcast has grown to include interviews with innovators in many facets of the insurance industry. Insurance Nerds has gathered a broad range of voices speaking to young professionals as well as a thriving network of young professionals networking with each other through their Slack community. Their bookshelf now includes titles they have published including The End of Insurance As We Know It, When Worlds Collide as well as several new titles they will release in 2020. As a positive sign of their growth in the last five years, Carly Burnham has now become the CEO and first official full time employee. If you are in the insurance industry, you will find the resources available through Insurance Nerds to be invaluable to your efforts for career development.

0 Comments

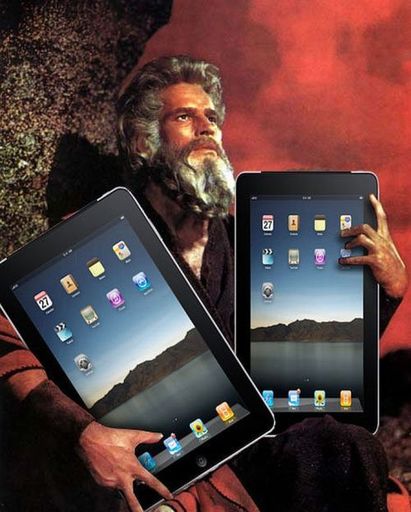

Learn the secrets to success writing insurance claims with the Xactimate estimating platform. The insurance claims estimating world can feel like a wandering in the dessert for restoration professionals. The frustration with the guidelines of program work and having to be reviewed by third party administrators (TPAs) can bring mitigation and construction estimators to a point where they feel lost and leaderless. Anyone who manages projects within the insurance claims industry must familiarize themselves with reading and writing Xactimate estimates. For those just beginning their journey in estimating insurance claims, you will find our Three R’s of Mastering Xactimate for Beginners to be a helpful baseline for success. The cloud of mystery that surrounds the stone tablets of this industry standard may scare and confuse many, but with the help of these ten commandments for Xactimate mastery you may find that you can achieve success. Estimating with Xactimate Commandment OneThou shalt sketch accurately. Regardless of the tools that you use, make sure that you get your sketch right. An accurate sketch is the key to creating a solid Xactimate estimate. Sketching from the site is one of the best ways to ensure you get odd corners and turns in a unique layout accurate as well as capture all of your line items. Second best is utilizing sketching programs or a good graph notebook. If you are new to sketching for construction estimates, property restoration or Xactimate, check out this video on the foundations of a good diagram. Estimating with Xactimate Commandment TwoThou cannot take too many photos. For those who started in the industry when we had to print photos or save them on 3.5 in floppy disks, there may be some hesitation to take too many photos. With modern digital technology this is no longer true. The more photos that you take the better. Always take photos of the front of loss, source, shots from all corners of affected rooms, affected materials, equipment and any unique components of the claim. Learn what carriers and adjusters are looking for as it is a terrible waste of time to have to run back out to a project just for one shot to justify a key line item. Estimating with Xactimate Commandment ThreeThou shalt label they photos descriptively. Common descriptions should include the room name and what is being represented with the photograph such as “Kitchen floor damage” or “Living room ceiling affected”. Carriers are often requesting that photos be uploaded in relationship to the sequence of rooms in the sketch, this can be easily done by dragging photos into the rooms when uploading into Xactimate. Estimating with Xactimate Commandment FourThou shalt utilize thy F9 notes. F9 notes can be used for formatting but breaking up large sections of line items into categories that make the estimate easier to read for reviewers, adjusters and your production teams. F9 notes can be used to describe how a line item is being utilized, for example DRY LF may have an F9 note of “Repair flood cuts for common wall to bathroom” especially if there is another drywall line item in the room that may be for the ceiling or separate section of wall. If you ever utilized a labor (LAB) line item you must understand that it is going to be questioned and should have an ample F9 note, photographic support for the scope being requested and best to have the designation as “approved by adjuster,” assuming that you have already discussed it with them. Communication is key, utilize this simple function. Estimating with Xactimate Commandment FiveThou shalt document your initial findings. Whether it’s a 12 hour update for a mitigation claim or a loss narrative for a repairs claim, you need to communicate the conditions you have found once you have completed your inspection. For mitigation projects you are communicating the site conditions, source and drying plan. For repairs projects you are confirming the site conditions and outlining the scope of work that you are estimating for. Samples of what should be covered in the twelve hour update as well as the loss narrative for Xactanalysis include: Sample 12 hour update for mitigation projects in Xactimate:

Sample loss narrative for repairs projects in Xactimate

Estimating with Xactimate Commandment SixThou shalt update thy adjuster in real time and document consistently. One of the keys to success for any organization or project management system is communication. A key principle for communication in the insurance claim industry is no surprises. Utilize email, text, phone calls and third-party programs such as Xactanalysis to communicate consistently and clearly with all parties. While some adjusters may have you wait until the end of a claim to compose all of your supplements and changes, you want to make sure that you aren’t waiting until then to communicate and acquire some form of written approval. You want to build relationships with adjusters and claims administrators and communication is a means to making their job easier by not surprising them with alterations to the plans previously agreed to. Estimating with Xactimate Commandment SevenThou shalt learn thy carriers guidelines. While it is impossible to remember all of them unless you are able to specialize with specific carriers, it is important to know the key rejection line items. Pay attention to what you are getting rejected for. Try to not repeat the same mistakes with the same carriers. Every carrier has their general rules as well as their idiosyncrasies. For example one carrier will want contents as CON LAB and another will want to see it as CON ROOM. It should only take one rejection for you to understand and remember which carrier prefers the line item one way or the other. Estimating with Xactimate Commandment EightThou shalt know thy line items – apply thyself to understand the process of line item approvals. If you do not want to be constantly frustrated by rejections you must quickly learn which line items will get rejected by reviewers or will require adjuster approval. When working with third party administrators (TPAs) you will have to work through layers of review and approvals based upon insurance carrier guidelines. If you have a scope of work that falls outside of the norm you will need to get in communication with the adjuster to discuss how they would like that scope of work broken down. A scope and line items that may not pass through the normal review process can be overridden if there is ample explanation through F9 notes, photos and the designation that this has been “approved by adjuster”. Memorization of line items can help boost Xactimate estimating success and expedience

Estimating with Xactimate Commandment NineThou shalt know thy line items – thou shalt understand thy line item descriptions. When you start writing estimates in Xactimate you need to take some time to familiarize yourself with what is and isn’t in a line item. As a general rule, most carriers do not want you to utilize labor (LAB) line items as in theory everything that needs to be done should be covered in a line item scope of work. For those items that are out of the ordinary you need to ensure that there isn’t an Xactimate line item that covers the work you are requesting labor for. Also, ensure that you aren’t duplicating a scope of work that is already covered in the line item while also ensuring that you aren’t cutting yourself short by missing items that are omitted from the line item description. Estimating with Xactimate Commandment TenThou shalt learn to master the tri-fecta of service, expedience and accuracy. Restoration creates the challenge of getting in and getting out expediently while providing a quality service and communicating with multiple parties. When the scope of work falls outside of the timeline requirements be sure to communicate and update frequently. Restoration professionals have to be skilled in the construction and mitigation trades, must be able to provide a high level of customer service which is grounded in communication and are required to be technologically proficient to utilize the industry tools. Insurance claims estimating mastery starts with knowing the guidelines of XactimateWhen Moses came down from Mount Sinai with the two stone tablets, there were questions and fear, but there were also some clear directives. Xactimate and program guidelines generate similar emotions but one cannot argue that there are keys to success when working with the estimating software. You can argue all you want about who gave the directives, who is interpreting the guidelines and whether the system is fair, but you also had better apply your energy to learning Xatimate’s keys to success. If you are just starting out in your estimating journey, you may find our Three R’s of Mastering Xactimate for Beginners to be helpful. Insurance claims are subject to some level of interpretation so mastering the tools of the trade is essential to achieving success with the process. Contact us for coaching and consultation with estimating, project management and process improvement.

Interview with Tony Canas, co-author of Insuring Tomorrow Interview with Tony Canas, co-author of Insuring Tomorrow We love reading the stories of the successful once their journey has reached a point that they can drop bombs of wisdom on us about how they reached a level that we can admire. But what does innovation look like at the ground level, while it is still happening? What does it look like when you have an idea, you connect with a few people who get it, you begin to collaborate and build towards conquering your dreams? Tony Canas and co-author Carly Burnham (read our interview with Carly HERE) have found a piece of the puzzle that they are skilled and passionate about, they have collaborated to create InsNerds and co-authored a book, Insuring Tommorrow, to share their insights and story. To interact with Tony is to engage with an aspect of innovation that is gaining momentum through hard work, creativity and collaboration within an industry (like all industries) that is in need of innovation. Tony is digging into a subject that many are reticent to touch, the recruitment, development and retention of Millennials. In doing so, Mr. Canas has become a known blogger, author and speaker on the topic with his session "Recruiting and Retaining Millennials" being delivered at the CPCU Society Leadership Conference and Annual Meetings for 2014. Our thanks to Tony Canas for taking the time to share with us. (Jon Isaacson / IZ Ventures): When kids are asked in high school what they dream of becoming, the insurance industry is not one of those top 10 career choices, what brought you into this field? Tony Canas: Like almost everybody else I fell into insurance by accident. It was 2009 and I was living in Des Moines, Iowa, one of the top insurance cities in the US, and got downsized from my job as a fleet manager with a transportation company when the economy crashed. I started applying to a bunch of jobs and it just so happened I landed at the Farm Bureau Claims Call Center and immediately fell in love with the industry. What aspects of insurance are you currently engaged in, what does your day-to-day look like? In my day job I’m a middle market underwriter for a major national carrier and I manage the state of Mississippi. We have a lot of verticals (energy, public entity, construction, healthcare, etc) so I end up underwriting a lot of manufacturing, retail chains, wholesales, restaurant chains and hotel chains. You are building quite a presence through blogging at InsNerds.com, having written Insuring Tomorrow and with your speaking engagements, what are your goals with these entrepreneurial endeavors? I spend a lot of my free time growing and promoting InsNerds, our two podcasts and marketing our book Insuring Tomorrow. I also have keep evenings a week devoted to “micro-mentoring” other insurance professionals. I help them figure out where they want to go and how to get there and see if I can open some doors out of my 10,000+ LinkedIn connections. I’ve been doing it for a few months and some of my mentees have already scored better jobs which is incredibly rewarding! Anyone can grab some time on my calendar at ChatWithTony.com, although at times the wait can be a couple of weeks. On the writing side I work on bringing in new authors to InsNerds and writing some of my own articles (mostly about career growth) and we’d like to write a second book. On the speaking side I speak at insurance conferences about Engaging Millennials in Insurance as often as I can. The speaking invites have really picked up since the book came out and I love it! I've talked to several people that have ideas or some level of desire to write a book, for you what was the catalyst that brought you to writing Insuring Tomorrow? I waited five years for somebody to dedicate a book to the important topic of how to engage Millennials in our industry, and nobody did. Finally one day my girlfriend came home and told me “It’s time to write the book”. I called Carly (my co-author) and said “it’s time to write the book”. Then we just did it. I’m not saying it was easy, but after years of being passionate about the topic and collecting reference material actually getting it done wasn’t too bad. We wrote it in about 90 days and sales have been better than expected and the reviews very positive. In that process of formulating your thoughts into a book what was easier than you expected and what was harder than you expected in that process? It was both… What I mean is that while it was hard to sit down and write a table of contents to plan the different chapters, once that was done it was easy to write the draft for most chapters. The tough part was having to cut some of the chapters we originally planned for because we couldn’t find enough data and outside resources to really back them up. We wanted the book to leave the reader with a pretty airtight case, not just our opinion, but rather ideas backed by tons of outside research. Overall it took a LOT of time, and we stayed up late very often during the process, but it was mostly enjoyable and incredibly worth it. What have been some of the positive responses to your book? The topic of Millennials is rather charged, has there been much opposition to your publication? While there is absolutely a lot of “millennial fatigue”, the response has been almost completely positive. I think most people in the industry recognize that while we have talked a lot about the topic, we really haven’t solved it and we MUST solve it. Some of my favorite reviews said, “It is truly outstanding.” “Every insurance CEO should read this.” and “Essential reading for insurance executives.” One early reviewer called it, “The best book on understanding culture since Malcolm Gladwell’s Outliers.” The book is available at InsuringTomorrowBook.com The subject matter that you are speaking to centers around the topic of Millennials in the workforce, as such what is one key piece of advice that first you would give to leaders working with millennials and then to millennials who are either entering the workforce or seeking to better themselves? It’s hard to digest five years of research into a 250 page book, let alone a one hour talk and even harder into a couple of sentences, but I’d say the best way to understand Millennials is think of them as a different culture. Not better or worse, just different. And try to understand them in that context. Also, look at the numbers and realize that this will be a MASSIVE change for our industry. The business world in general has been dominated by Baby Boomers for decades, there were 25% fewer Gen Xers so they will always remain a minority, as the Boomers retire business will have to reinvent itself to survive in an era where Millennials will be the bulk of the workforce for at least a couple of decades. What is next for Tony? Now that’s a hard question! My plans have changed a lot over the last few years and I’m sure they will continue changing. I do know that I’m staying in the insurance industry for the rest of my career and will continue running InsNerds. Chances are many other projects that I haven’t even imagined yet will emerge from the InsNerds umbrella. I will continue being a positive voice of change for our industry and will continue my efforts to help us recruit and retain a new workforce. Tony Canas regularly writes for InsNerds.com, he is on LinkedIn and tweets as @TonyCanas4. Insuring Tomorrow has many applications outside of the insurance industry and is available for $20, you can find our review of the publication HERE.  Interview with Andrew McCabe of Claims Delegates Interview with Andrew McCabe of Claims Delegates How many people do you know who have a college degree and are working directly in the field that they studied for? Over the years of working with and interviewing professionals, there is a much more common thread of hard working people who put their careers in motion, met adversity and found a way to keep themselves moving forward. Thankfully we are a resilient species, we can find means of inspiration in our journey and if we are fortunate, we find people who will help expedite our progress. Andrew McCabe is an entrepreneur who has found ways to improve himself, is building a brand and has joined forces with like minded professionals who are seeking to innovate in their sector of the service industry. Our thanks to Andy for taking to the time to share a bit of his story and some of the snippets of success that have helped bring him to where he is as an independent adjuster, author and founder of a restoration conference. You don't meet many people that set out to get into the insurance industry, how did you find yourself involved with this profession? I took a job as a marketing manager for a restoration contractor straight out of college. I have a marketing degree, so I thought it would be a good start. I soon learned that I knew very little about "real" B2B marketing. Colleges don't teach networking or relationship building. I was quickly moved into Project Management with WRT and ASD classes. The rest is history. Currently you are engaged in several entrepreneurial ventures so let's break down a few of those components. Do I understand correctly that your main gig is as an independent adjuster? Currently I write estimates for contractors across the country as my main gig. I only recently started working as an independent adjuster out of necessity because we had a CAT [Catastrophic Loss Event] hit Bend, Oregon and it was all hands on deck. What was the catalyst for launching out on your own? The catalyst for starting out of my own was out of necessity, I had been fired three years in a row from three different jobs. I decided in late 2012 that I would never be fired again so I decided to work for myself, go figure. So, I started writing Xactimate estimates for whoever would hire me and most folks thought I was crazy and that the idea would never take off. But now we're here we are almost 5 years later there are several companies across country that do exactly what I do; write Xactimate estimates for other people I feel like the market is changing and the restoration industry which has been historically 15 years behind the time is going to be swept up in these changes. Writing estimates independently is only the beginning of what I see as a automation of the entire industry. You have written a book and developed a program around that publication titled The 24 Hour Tech, what is the story behind developing this program and what is the elevator pitch for how it benefits the water damage service providers in our industry? The 24 hour tech is another example of desperation and necessity being the mother of invention. I was working with a ServiceMaster franchise in Scottsdale, Arizona as the sole estimator, project manager and general manager. I was stuck with whomever the owner decided to hire in the given moment and I found myself training and retraining employees two and three times a month. I also found it difficult to find time to get to every single project that I had to estimate in any given day. The TPA [Third Party Administrator] framework made it almost impossible for me to do all the jobs that I needed to do. I needed to find a way to have the water damage technicians do my job for me in that I could sit back at the office and do estimates while they gathered the data and took the pictures for me. I developed The 24-hour Tech System to accomplish both things. I was able to train new water damage technicians quickly and I was able to get the information that I needed as an estimator back at the office without having to visit every single job myself. The crazy thing in my mind is that the franchise did not provide a system of training or documentation that accomplished what the 24 hour tech accomplishes so elegantly and simply. One of our taglines is "connect, collaborate and conquer", you have brought together a group of industry professionals and are putting together a conference that will meet this year, Restoration 2.0 Summit. How long has this idea been in the works and what was the catalyst for making it happen? I had/have been receiving email after phone call from folks who all have the same problems, frustrations and desires. There are so many of "US" out there, that someone had to give it a name and a place. That is the Restoration Alliance. The Rebels are the forward face and voice. But the Alliance is deeper and wider than even I could have imagined. We decided to hold this event in December/January this year. It just felt like the right thing to do. For those who haven't heard or may be on the fence, what is the primary benefit of attending R2.0? The primary benefit of the Restoration 2.0 Summit is connection and inspiration. We are all in this together, even those who chose to go it alone. We've covered three areas of your efforts, what would you say is a key piece advice either collectively or individually for restoration professionals as a collective body? I've been writing this email for the past several days, and I could go on for pages if I had the time. For brevity's sake I will say this: we need to look for and recognize the humanity in the things we do and folks we see every day. Yes, the "system" is flawed and downright frustrating. If we pause to see the PERSON sitting across from us, and next to us, we can start to find the wins without giving up our souls. You can find more about Andrew McCabe and his work through claimsdelegates.com, he is on LinkedIn and tweets as @claimsdelegates. The Restoration 2.0 Summit will be hosted in Bend, Oregon on September 29, 2017. ᐧ |

AuthorThoughts on personal and professional development. Jon Isaacson, The Intentional Restorer, is a contractor, author, and host of The DYOJO Podcast. The goal of The DYOJO is to help growth-minded restoration professionals shorten their DANG learning curve for personal and professional development. You can watch The DYOJO Podcast on YouTube on Thursdays or listen on your favorite podcast platform.

Archives

March 2023

Categories

All

<script type="text/javascript" src="//downloads.mailchimp.com/js/signup-forms/popup/unique-methods/embed.js" data-dojo-config="usePlainJson: true, isDebug: false"></script><script type="text/javascript">window.dojoRequire(["mojo/signup-forms/Loader"], function(L) { L.start({"baseUrl":"mc.us5.list-manage.com","uuid":"b9016446bd3c6a9f0bd835d4e","lid":"83282ffb9e","uniqueMethods":true}) })</script>

|

Jon Isaacson |

Connect. Collaborate. Conquer.

© COPYRIGHT 2015. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed